There are a variety of market indices that serve as statistical indicators of market performance。Many investors compare the Dow Jones Industrial Average(DJIA) or Nasdaq 100 An index is considered a benchmark or representative of the entire stock market。The downside is,These indices are only composed of 30 Tadakazu 100 Composed of only stocks。12

Perhaps the best-known and most commonly used market index to measure market performance and an indicator of the health of the economy is the Standard & Poor's 500 index。Standard & Poor's 500 Index from the United States 500 The largest companies are composed of weighted proportions。Market value。3

Continue reading,Discover other market indices that can reveal the entire stock market。

Main points

- Many investors compare the Dow Jones Industrial Average (DJIA) or Nasdaq 100 One of the major indexes is considered a broad market index。

- A better representative might be Wilshire 5000 or Russell 3000,Because they consider nearly the entire investable stock market,Includes large-cap stocks、Mid-cap and small-cap stocks。

- Standard & Poor's 500 Index is the most popular index,It is also the index used by most investors and analysts to gauge the health of the U.S. economy.。

- past ten years,Nasdaq 100 The index handily outperformed other major market indices。

market index

Wilshire 5000

FT Wilshire 5000 The Total Index Series is one of the most broadly representative of the entire market.。

Contrary to what its name implies,Wilshire 5000 Can contain more than 5,000 Just more (or less) stocks。As of March 31, 2023 (latest information),The index contains 3,480 stocks。The purpose of the index is to "reflect the performance of all publicly traded U.S. equity securities with ready prices。4”5

largest exchange traded funds (ETF) Yes SPDR S&P 500,It tracks S&P 500 index。6

Russell Index

For investors interested in the performance of small-cap stocks,One of the most widely followed indices is the Russell 2000。Russell 2000 Index tracks 2,000 U.S. small-cap companies。Small-cap companies tend to be riskier,because they have a lower survival rate。7

Now,Russell 2000 Select the smallest stock from the Russell 3000 index。Russell 3000 The index covers the entire U.S. stock market for nearly 98% stocks,Focus on all large-cap stocks、Mid-cap and small-cap stocks。its exposure is very broad。Russell 3000 and Wilshire 5000 similar in this respect,Therefore their performance is similar,As shown in the performance table below。87

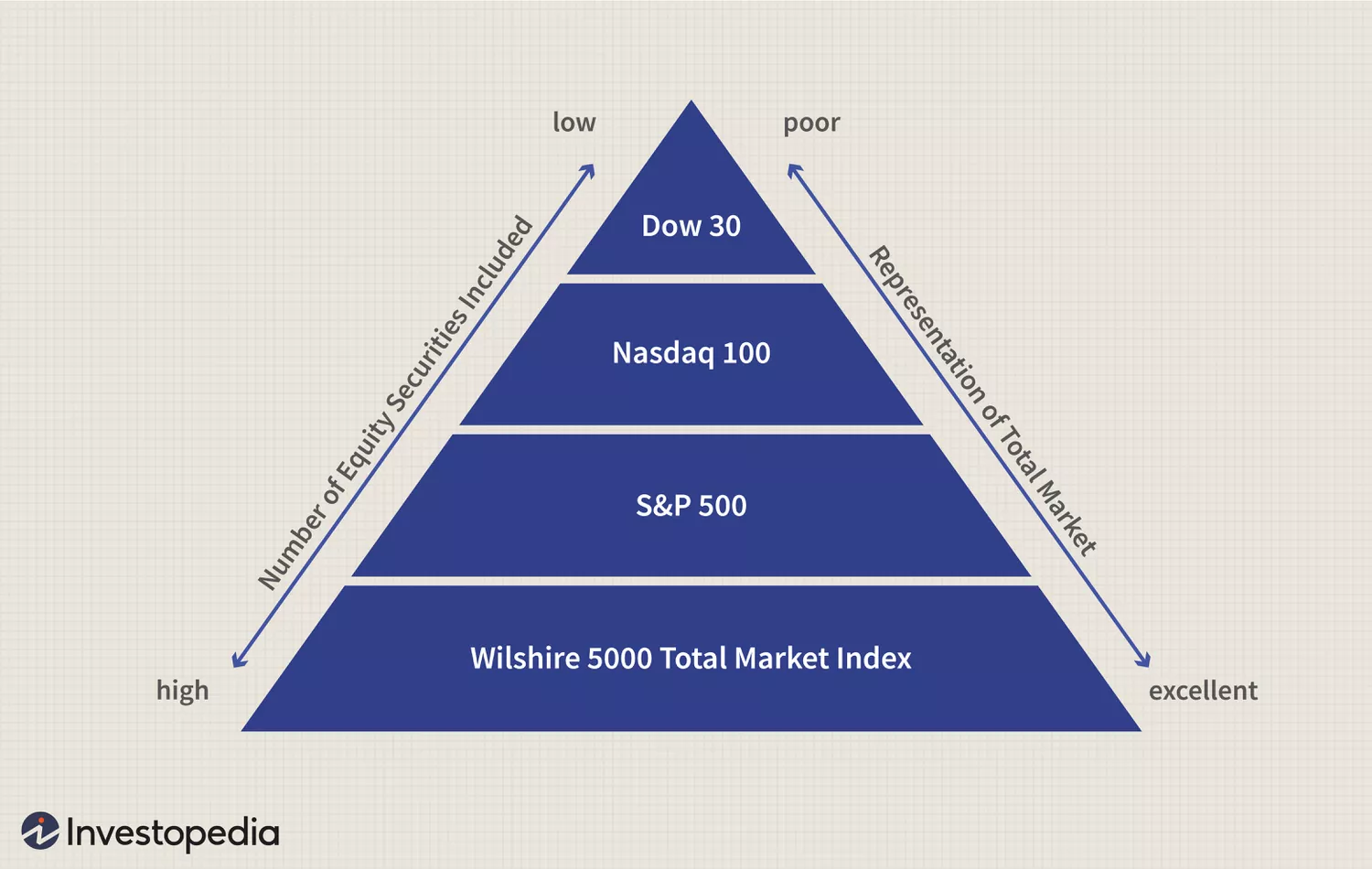

The chart below illustrates the number of securities and how representative each index is。

Image source:Sabrina Jiang © Investopedia 2020

Image source:Sabrina Jiang © Investopedia 2020

market index returns

at last,Let’s take a look at how these market indexes have performed over the past five and ten years。Widely used Dow Jones and Nasdaq 100 Indexes are broad market indices,But they track very different companies。first,Dow tracks Caterpillar、Companies like Cisco and Coca-Cola;in many cases,Large-cap companies pay stable dividends,But the growth rate is not large。9

at the same time,Nasdaq 100 The index is mainly based on technology stocks,Own stocks like Netflix and NVIDIA。The technology industry has experienced significant growth over the past decade。therefore,In the long run (in this case 10 Year),Nasdaq 100 It’s no surprise that the index outperformed all other indices。The worst performer was Russell 2000 index,as mentioned before,The index focuses on smaller companies。10

Standard & Poor's 500 Indexes fail to beat Russell 3000 index or wilshire 5000 index,Both indexes include a wider range of stocks than the S&P 500 The index is much broader。Here are the five- and ten-year performances of each index as of the date Notable。31121213

| stock market index returns | ||

|---|---|---|

| return the goods | 5Year | 10term |

| Dow (as of 2023 Year 10 moon 17 day) | 5.75% | 8.26% |

| Nasdaq 100 index (09/29/2023) | 15.06% | 17.64% |

| Russell 2000 (10/17/2023) | 3.52% | 6.25% |

| Russell 3000 (10/17/2023) | 10.41% | 11.14% |

| Wilshire 5000 (2023 Year 3 moon 31 day) | 10.69% | 11.92% |

| Standard & Poor's 500 index (10/17/2023) | 9.26% | 9.70% |

Can you invest in market indices?

No,You cannot invest directly in market indices,Because they are simply indices that track certain areas of financial markets。However,There are many mutual funds and exchange-traded funds (ETFs) that track these indexes,Investors can invest in these indices to gain investment opportunities。

What is the European stock index called?

Many countries in Europe have their own stock markets,therefore,There are quite a few popular European stock indexes。The most popular of these is FTSE 100、Euronext 100、DAX and CAC 40。

Standard & Poor's 500 What sectors does the index include?

Standard & Poor's 500 Industries included in the index include information technology、healthcare、finance、consumer discretionary、communication services、industry、consumer staples、energy、Material、Utilities and Real Estate。14

Summarize

Stock market indexes are designed to track certain sectors of the stock market。Some want to cover as much of the investable U.S. stock market as possible,Wilshere 5000 Indexes and Russell 3000 index。Others take a more narrow view,For example, in the Dow 30 Only the highest quality stocks。

Some indices are very niche,They focus on very specific industries,such as a mining company or a semiconductor company。When investing in an index-tracking fund,Investors have many options,Enables investors to pursue investment opportunities across the stock market as well as within specific sectors。