As Hamas militants launch deadly attacks on Israeli civilians、Russia invades Ukraine、Iran and North Korea pose nuclear threat,The world is witnessing a surge in violence and instability。Such conflicts and confrontations are not only detrimental to peace and security,and has a global impact on the economy and global stock markets。For example,In fiscal year 2022,The United States spent about 8trillion dollars,A large proportion of GDP,and contribute to economic growth in certain sectors。1

But how does war affect the economy and stock markets more broadly? Security experts are weighing in,Only time will tell,But experts remind us,in the long run,Past wars haven't depressed U.S. stocks。How will the market react this time?

Main points

- Although war and defense spending may account for a significant portion of U.S. gross domestic product,But wars tend to have little lasting impact on domestic stock markets or economic growth。

- Markets have largely ignored recent conflicts related to the Middle East and Iran。

- However,A wider regional war could have more serious repercussions,Especially the impact on oil and other commodity prices。

- despite this,Within days or weeks after an armed conflict or confrontation begins,Stock markets tend to quickly return to pre-invasion levels。

The market often dismisses this

War often brings a degree of uncertainty,And markets usually don’t like that kind of uncertainty。The outbreak or expectation of war could cause a sharp sell-off in stocks。at the same time,Investors may turn to traditionally safer assets,like gold、Bonds or currencies considered safe havens。Despite the initial negative reaction,but as time goes by,Stock markets show resilience。in fact,As the situation stabilizes or the scope of the conflict becomes clearer,they tend to recover quickly。

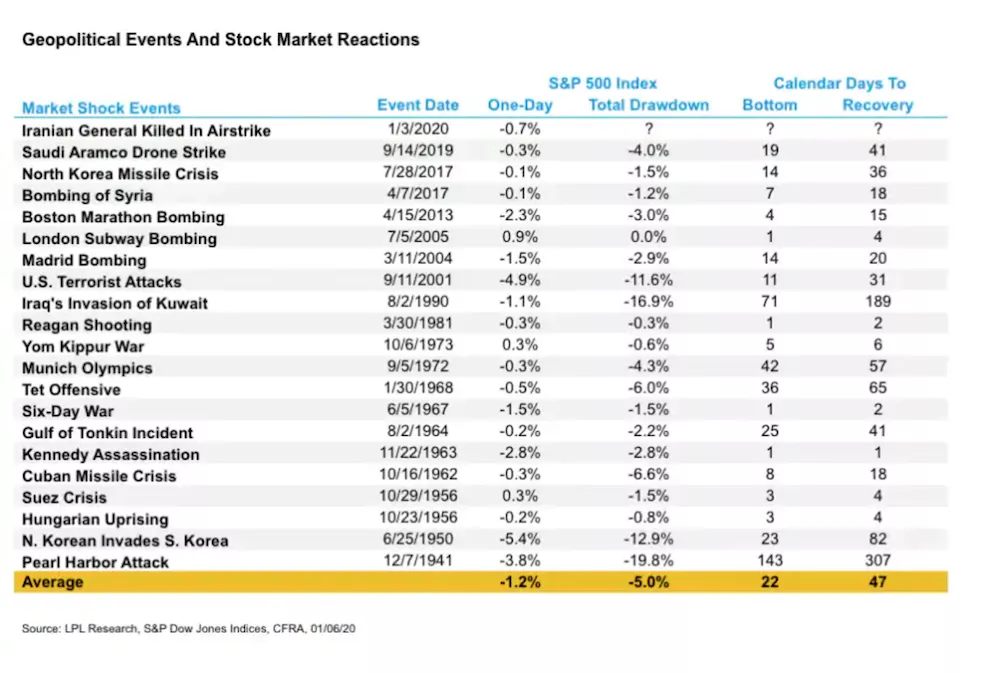

LPL Financial research states,Stock markets have largely shrugged off past geopolitical conflicts。John Lynch, former chief investment strategist at LPL Financial (John Lynch) talking about 2020 Year 1 U.S. airstrike kills Iranians,"Although this escalation is serious,But past experience shows,It is likely unlikely to have a significant impact on U.S. economic fundamentals or corporate profits."。General Qasem Soleimani。“Given that equity markets have experienced heightened geopolitical tensions in the past,We won't be the sellers of stocks that fall into weakness due to this event。”23

"from 1939 World War II begins 1945 End at the end of the year,The Dow rose in total 50%,Rising more than every year 7%。therefore,In two of the worst wars in modern history,Ben Carlson, director of institutional asset management at Ritholtz Wealth Management in the U.S. stock market, writes in an article about the counterintuitive market results:"The total has increased 115%。“The relationship between geopolitical crises and market outcomes is not as simple as it seems.。”4

Source:LPL Finance。

Source:LPL Finance。

From Russia's invasion of Ukraine to S&P one month later 500 index priceAnother example is Russia's 2022 Year 2 moon 24 After Japan invaded Ukraine,shocked the global market。5in the united states,As the United States and other countries tighten tough economic sanctions on Russia,and investors worried about the impact of commodity prices,Standard & Poor's 500 Indexes fell in the days and weeks after the attacks 7% That's all。but,The market rebounded a month later,The S&P trades above pre-invasion levels,Although oil prices are still higher than a barrel 100 Dollar。

Standard & Poor's 500 index 2022 Year 2 moon 24 Solstice 3 moon 24 day。

Standard & Poor's 500 index 2022 Year 2 moon 24 Solstice 3 moon 24 day。

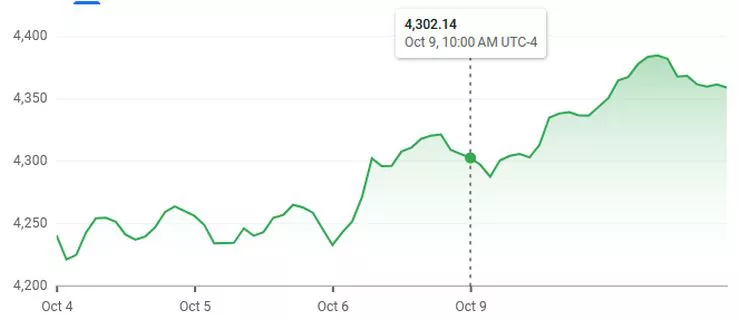

Standard & Poor's 500 Index Prices From Simchat Torah Hamas Massacre of Israeli Civilians to Days LaterLatest clashes between Israeli and Palestinian activists,This conflict started 10 moon 7 Hamas fighters from Gaza killed and kidnapped on Saturday 1,300 Multiple Israeli civilians in 2023,Standard & Poor's 500 Index briefly fell on first trading day after these tragic events。6But as the Israeli Army and Air Force responded,The S&P actually rose the following week。Since the conflict involves the Middle East,And other regional interests may also be involved in the conflict,Oil price per barrel 83 The U.S. dollar edged up around 86 About U.S. dollars,but still far below 2023 Year 9 observed in month 94 Recent highs around the U.S. dollar。

when markets are affected

history tells us,Periods of uncertainty like what we are seeing now are often when stock markets suffer the most.。2015Year,Swiss Finance Institute researchers study U.S. military conflicts after World War II,Found in the pre-war phase of the situation,Increased likelihood of war tends to cause stock prices to fall,But the eventual outbreak of war will increase their。However,In the event of a sudden outbreak of war,The outbreak of war will cause stock prices to fall。They called this phenomenon the "mystery of war.",and expressed,There is no clear explanation why the stock market rose sharply in the lead-up to the war.。7

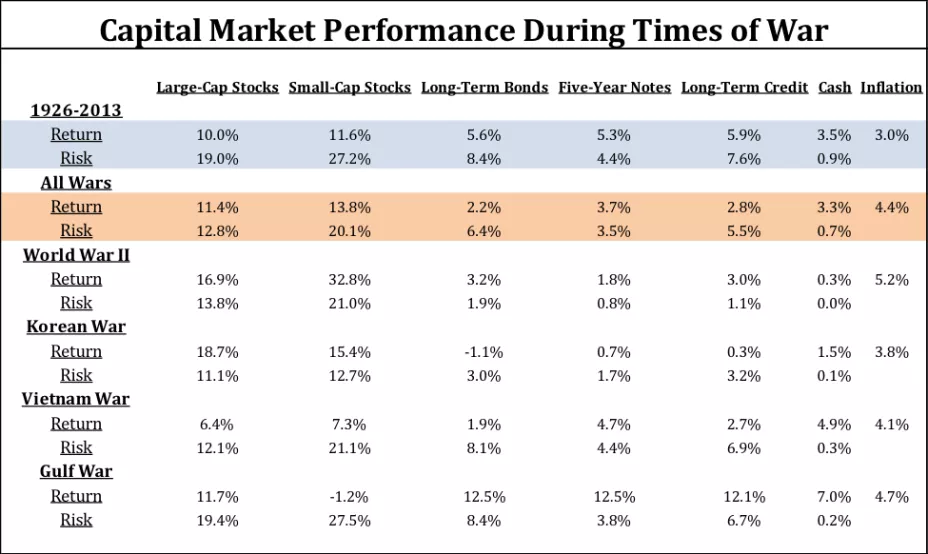

same,Mark Armbruster, president of Armbruster Capital Management, researched 1926 New Year's Eve 2013 Year 7 month period,Stock market volatility was actually lower during the war, found。"Intuitively,One would expect uncertainty in the geopolitical environment to spill over into stock markets。However,This is not the case,Except during the Gulf War,Volatility at that time was roughly in line with historical averages,"He said。8

Source:Mark Armbruster/CFA Institute。

Source:Mark Armbruster/CFA Institute。

However,On the ongoing conflict with Iran,Investors react lukewarm to headlines。"If 2019 What has the year taught us?,That is you have to follow your own process as much as possible,Don't get caught up in the headlines,"Todd Thorne, Technical Director at Strategas (Todd son) to the Washington Post express。"The sad thing is,I wonder if we're used to it。I wonder if the market has learned to discount these events。”9

David Kelly, chief global strategist for J.P. Morgan Funds, said in a report:“Part of the market calm may be due to changes in the structure of the global oil market,and how the U.S. economy can become less vulnerable to energy price swings。"Part of it may be purely psychological."。Investors today have seen the stock market go from 9/11 and recovery from the financial crisis,This is arguably the greatest geopolitical and economic shock of our time。This makes it easier for investors to shrug off other impacting events."。9

A broader conflict with Russia could also cause oil market volatility,Because Russia is a major producer of crude oil and natural gas,Its pipelines supply oil to many parts of Europe。If Russia shuts off the spigot or oil infrastructure suffers major damage,May lead to higher energy prices。Disruptions at ports around the Black and Baltic Seas could also cause deeper shipping congestion,and lead to food inflation,as grains and other staples remain stranded at sea。10

Why did the stock market remain resilient during the war?

in the united states,Stock markets tend not to be affected by initial downturns triggered by conflict。in some ways,War can satisfy the military needs of combatants by promoting industrial production,thereby benefiting economies not directly affected by the conflict。The development of new technologies, some of which have private sector applications, is also often driven by armed conflict。

Which stocks performed best during the war?

Generally speaking,Defense stocks (companies that produce weapons and armaments) tend to perform best in wartime environments。Energy companies may also see increased conflict,leading to higher oil and commodity prices。

How did stocks perform when the world war broke out?

first world war:When World War I broke out,Stocks fell approx. 30%,Market closed for six months。when they reopen,The Dow is at 1915 rose in the year 88% That's all。11

Second World War: 1939After Hitler invaded Poland,The stock market actually rose 10%。After Japan's attack on Pearl Harbor,Stocks fell 2.9%,But it recovered its losses within a month.。from 1939 New Year's Eve 1945 The war ends at the end of the year,Dow rose 50%,11

Summarize

"In the past few years,Markets have been conditioned not to overreact to political and geopolitical shocks,There are two reasons:first,It is believed that the initial shock will not be significantly exacerbated;Secondly,The central bank is ready and capable Mohamed A. El-rian, chief economic adviser to Allianz Group. El-Erian)Bloombergexpressed in the column。12

But he warned,Investors who buy on dips should adopt a selective overall strategy。“This includes an emphasis on high-quality transactions underpinned by strong balance sheets and high cash flow generation,Resist the strong temptation to shift massively from U.S. assets to international investments,and reducing exposure to inherently less liquid markets. These areas have experienced beneficial spillovers from extraordinary central bank stimulus and the general impact on yields and returns.,"he said。