什么是账面价值?

对于价值投资者来说,Book value is the sum of the amounts of all items on the stockholders' equity portion of a company's balance sheet。You can also calculate book value by subtracting a business's total liabilities from its total assets.。

Accountants also use book value to evaluate the assets a company owns。This is not the same as the investor's book value,Because it is used internally for management accounting purposes。

Main points

- 公司的账面价值是资产负债表中股东权益部分所有项目的总和。

- Book value is often different from the market value of the company。

- Using book value per share in fundamental analysis (BVPS) and price-to-book ratio (P/B)。

了解账面价值

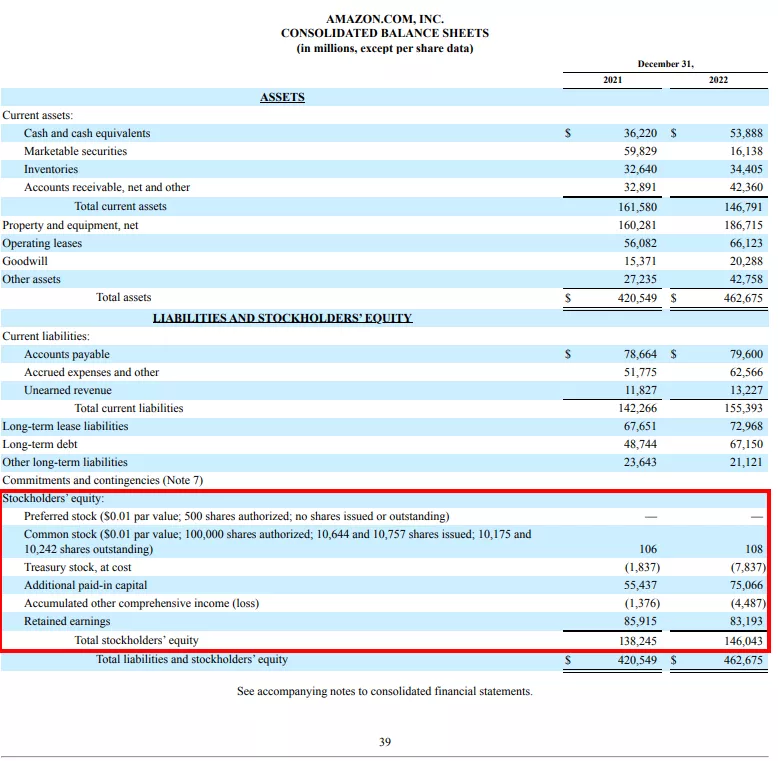

股东权益是公司资产负债表上的一个部分,It explains where their money is going。The chart below is Amazon’s consolidated balance sheet for fiscal 2022。Note liabilities and stockholders' equity (in the red box,Also called stockholders' equity) section。1

on the balance sheet,You'll see "Total Stockholders' Equity",Value is 1,382 billion US dollars。This figure is calculated by converting preferred shares、common stock、national debt、Paid-in capital、Calculated by adding the value of additional comprehensive income and retained earnings。Some companies include unrealized gains and losses、Capital surplus or accumulated adjustments and many other items,Depends on the industry the company operates in and its internal accounting procedures。

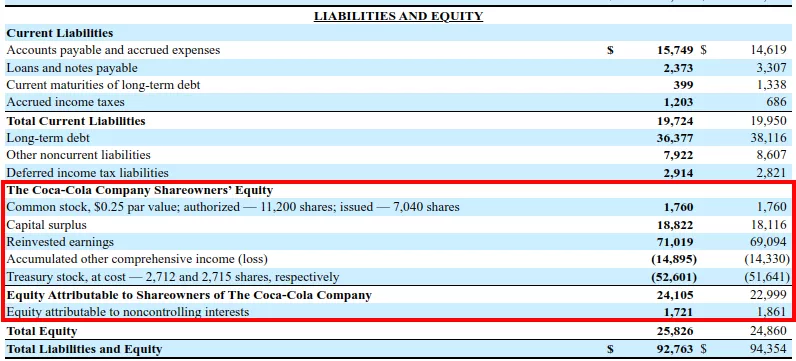

The chart below shows that Coca-Cola has an "Equity attributable to Shareholders" line。in this case,This would be how investors assess Coca-Cola's book value。2

Since the company's book value represents the equity value,So when trying to determine whether a stock is fairly priced, Comparing book value to a stock's market value can be an effective valuation technique。

账面价值用途

账面价值有两个主要的投资者用途:

- 它用于其他财务比率以帮助投资者评估公司

- 作为与公司市值的比较,Book value can indicate whether a stock is underpriced or overpriced。

Book value is also included in some financial ratios,Can help investors understand more about a company’s financial health。

book value per share (BVPS)

book value per share (BVPS)It is a fast calculation method,Used to determine a company's per-share value based on the amount of its common stockholders' equity.。To get BVPS,Divide total stockholders' equity by the total number of shares of common stock outstanding。

therefore,If a company has 2100 million in stockholders’ equity and 200 10,000 common shares outstanding,Then its book value per share will be 10.50 Dollar。please remember,This calculation does not include any other line items that may be included in the stockholders' equity section,Includes only outstanding common shares。

There is a difference between outstanding shares and issued shares,However, some companies may refer to outstanding common stock as "outstanding" stock in their reports。

price to book ratio (P/B) ratio

当同一行业内的类似公司采用统一的资产评估会计方法时,The price-to-book ratio (P/B) is a valuation multiple that can be used to compare their values.。When comparing companies across different industries and industries,This ratio may not serve as a valid basis for valuation,Because companies record their assets differently。

therefore,A high price-to-book ratio is not necessarily a premium valuation,反之,A low price-to-book ratio is not necessarily a discounted valuation。

Calculating the price-to-book ratio is simple - divide the market price per share by the book value per share。In the previous example,The book value per share is 10.50 Dollar。therefore,如果该公司股票的当前市值为 13.17 Dollar,则其市净率将为 1.25(13.17 美元 ÷ 10.50 Dollar)。

为什么称为“账面价值”?

账面价值得名于会计术语,其中会计日记账和分类账被称为公司的“账簿”。in fact,会计的另一个名称是簿记。

price to book ratio (P/B) 为 1.0 意味着什么?

AP/B比率为1.0表明公司股票的市场价格恰好等于其账面价值。对于价值投资者来说,这可能是一个不错的买入信号,因为公司的市场价格通常比账面价值有一定的溢价。

为什么市场价值常常高于账面价值?

账面价值仅使用公司的股东权益总额。它可能不包括专利、知识产权、品牌价值和商誉等无形资产。它还可能无法充分考虑工人的技能、人力资本以及未来的利润和增长。therefore,市场价值——由市场(卖家和买家)决定,是考虑到所有这些因素后投资者愿意支付的价格——通常会更高。

Summarize

账面价值是公司总资产减去总负债的价值。in other words,它等于股东权益总额。公司的市场价值通常会大于其账面价值,因为市场价格包含了投资者对知识产权、人力资本和未来增长前景等无形资产的想法和计算。价值投资者寻找账面价值相对较低(使用市净率或 BVPS 等 指标)但基本面强劲的公司作为可能被低估的股票进行投资。

更正——八月 2023 Year 2 moon 24 day:本文对之前的版本进行了更正,该版本将管理会计账面价值与价值投资账面价值结合起来,这是两个不同的概念。正如文章现在正确指出的那样,投资账面价值是“股东权益总额”这一行项目或公司资产负债表中的同等条目。