preferred stock or common stock:Which one is better?

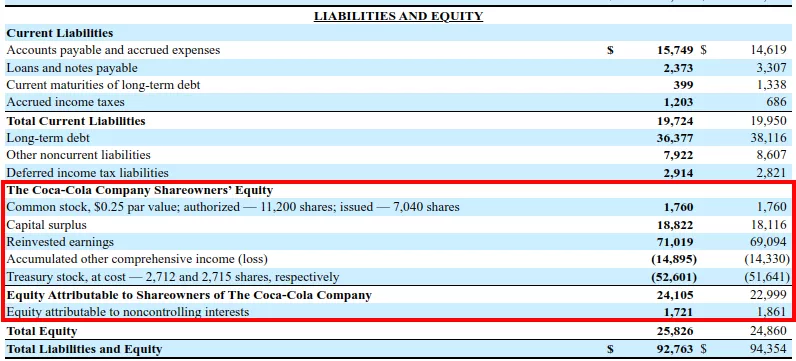

Common stock is your ticket to ownership in a company,rather than just a piece of paper (or now a digital entry)。Owning common stock allows you to vote for the board of directors and company policies,Gives you a say in how the company is run。over time,This stock has the potential to generate big returns。but there is a problem:如果公司必须清算其资产,Ordinary investors only have bondholders、Preferred stockholders and other creditors are not compensated until they receive their fair share。 The stockholders' equity section of a company's balance sheet contains information about the value of common shares outstanding。 Explanation of Common Shares Common shares are essentially a claim on a portion of a company’s assets and profits.,is a kind of ownership。as a shareholder,You are entitled to "fractional ownership",But this does not give you ownership of the company's tangible assets, such as computers or chairs.,These assets are owned by a company (a separate legal entity)。相反,as a shareholder,You have a residual claim to the company’s assets and earnings,This means you can keep the remainder after fulfilling all other responsibilities。 Common stock trades on an exchange,Available for traders or investors to buy and sell。Common stockholders are entitled to receive dividends as declared by the company's board of directors。Normally,The board of directors will consider the company's performance、future capital needs、Overall financial goals and other factors determine how to divide。Their compensation usually comes from the company's earnings。 preferred stock:what is it? compared to common stock,Preferred stock is a unique form of stock with separate rights。Preferred stockholders have a greater claim on the company's assets and profits than common stockholders.,Although both forms confer ownership of the company。The term "preferred" stock reflects this higher ranking。 Preferred Stock vs. Common Stock Investors can purchase company stock through common stock and preferred stock.,But they should note the important differences between the two。 Dividends A company can pay dividends to common and preferred owners。on the other hand,Preferred stock dividends are predetermined and determined by the stock's dividend rate and the stock's par value or face value。Companies are free to decide whether and how much dividends to distribute to ordinary investors。 If a company cannot pay dividends to all investors,Preferred stockholders receive dividends before common stockholders。Any missed dividend payments accumulate as "dividends in arrears" to cumulative preferred stockholders,and must be paid before dividends are distributed to common stockholders。 Corporate Bankruptcy When a company files for bankruptcy,its preferred shareholders、Bondholders and creditors are paid before common shareholders receive their share of the assets。therefore,Preferred stock or debt is less risky than common stock。 in the long run,Common stocks often have advantages over bonds and preferred stocks。Most businesses issue all three types of securities。For example,Wells Fargo offers a variety of bonds on the secondary market,Includes common stock (WFC) and preferred shares,For example, L series (WFC-L)。 Voting rights Company shareholders have the right to vote on major management-related decisions。For example,Board members are elected by shareholders。Voting rights are usually granted to common stockholders,Preferred stockholders are generally not granted voting rights。 Transactions and Price Changes in Open Markets,Both common and preferred shares can be traded。Investors can choose to buy or sell any kind of stock。 despite this,Common stocks are typically traded by investors,rather than preferred shares。Due to fixed dividends and lower risk profile,Preferred stocks generally have lower price volatility and higher growth potential than common stocks。Preferred stocks reduce volatility and provide stable dividends,This makes them popular with institutional investors looking for a stable source of income。also,These companies tend to trade less frequently than common stocks,This makes them less attractive to retail investors looking for quick profits。 Initial Public Offering A company must conduct an initial public offering (IPO) in order to issue shares。IPOs are an important means of growth for businesses looking for additional capital。Companies work with underwriting investment banks to decide on the type and price of shares before starting the IPO process。After the initial public offering (IPO) is completed,The stock is publicly available for purchase on the secondary market。 Advantages and Disadvantages of Common Stock Advantages and Disadvantages of Preferred Stock Which Investment Is Better:Common stock or preferred stock? Each category has advantages and disadvantages。Common stocks generally have greater volatility and higher potential returns。Although preferred stocks have less return potential,But it may be less volatile。This means preferred stocks will be chosen by long-term investors who can tolerate greater volatility,And common stocks will be preferred by those who wish to minimize this volatility。 Summary As the name suggests,One of the most common stocks is common stock。In addition to interests in the underlying business and voting rights in electing the board of directors,It also gives shareholders a claim on some of the company's assets and future earnings。on the other hand,Preference shareholders have priority in dividend payments and investment recovery in the event of liquidation of the company.,Put ordinary shareholders in a subordinate position。