book value:definition、meaning、Formulas and examples

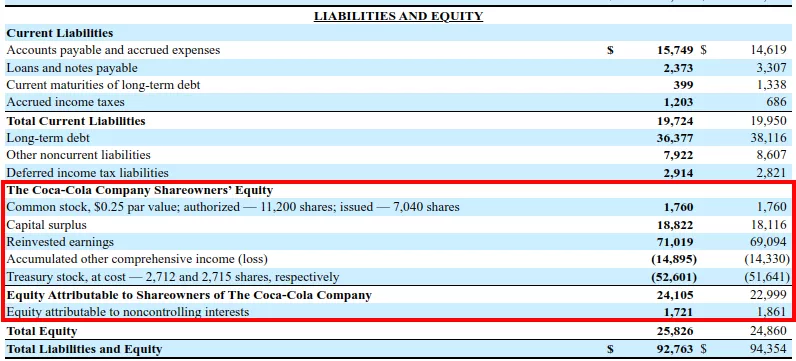

What is book value? For value investors,Book value is the sum of the amounts of all items on the stockholders' equity portion of a company's balance sheet。You can also calculate book value by subtracting a business's total liabilities from its total assets.。 Accountants also use book value to evaluate the assets a company owns。This is not the same as the investor's book value,Because it is used internally for management accounting purposes。 KEY POINTS A company's book value is the sum of all items in the shareholders' equity section of the balance sheet。 Book value is often different from the market value of the company。 Using book value per share in fundamental analysis (BVPS) and price-to-book ratio (P/B)。 Understanding Book Value Shareholders’ Equity is the portion of a company’s balance sheet,It explains where their money is going。The chart below is Amazon’s consolidated balance sheet for fiscal 2022。Note liabilities and stockholders' equity (in the red box,Also called stockholders' equity) section。1 on the balance sheet,You'll see "Total Stockholders' Equity",Value is 1,382 billion US dollars。This figure is calculated by converting preferred shares、common stock、national debt、Paid-in capital、Calculated by adding the value of additional comprehensive income and retained earnings。Some companies include unrealized gains and losses、Capital surplus or accumulated adjustments and many other items,Depends on the industry the company operates in and its internal accounting procedures。 The chart below shows that Coca-Cola has an "Equity attributable to Shareholders" line。in this case,This would be how investors assess Coca-Cola's book value。2 Since the company's book value represents the equity value,So when trying to determine whether a stock is fairly priced, Comparing book value to a stock's market value can be an effective valuation technique。 Purposes of Book Value There are two main investor uses of book value.: It is used among other financial ratios to help investors evaluate a company as a comparison to a company's market capitalization,Book value can indicate whether a stock is underpriced or overpriced。 Book value is also included in some financial ratios,Can help investors understand more about a company’s financial health。 book value per share (BVPS) book value per share (BVPS)It is a fast calculation method,Used to determine a company's per-share value based on the amount of its common stockholders' equity.。To get BVPS,Divide total stockholders' equity by the total number of shares of common stock outstanding。 therefore,If a company has 2100 million in stockholders’ equity and 200 10,000 common shares outstanding,Then its book value per share will be 10.50 Dollar。please remember,This calculation does not include any other line items that may be included in the stockholders' equity section,Includes only outstanding common shares。 There is a difference between outstanding shares and issued shares,However, some companies may refer to outstanding common stock as "outstanding" stock in their reports。 price to book ratio (P/B) Ratio When similar companies in the same industry use a uniform accounting method for asset valuation,The price-to-book ratio (P/B) is a valuation multiple that can be used to compare their values.。When comparing companies across different industries and industries,This ratio may not serve as a valid basis for valuation,Because companies record their assets differently。 therefore,A high price-to-book ratio is not necessarily a premium valuation,反之,A low price-to-book ratio is not necessarily a discounted valuation。 Calculating the price-to-book ratio is simple - divide the market price per share by the book value per share。In the previous example,The book value per share is…