How to measure the entire stock market

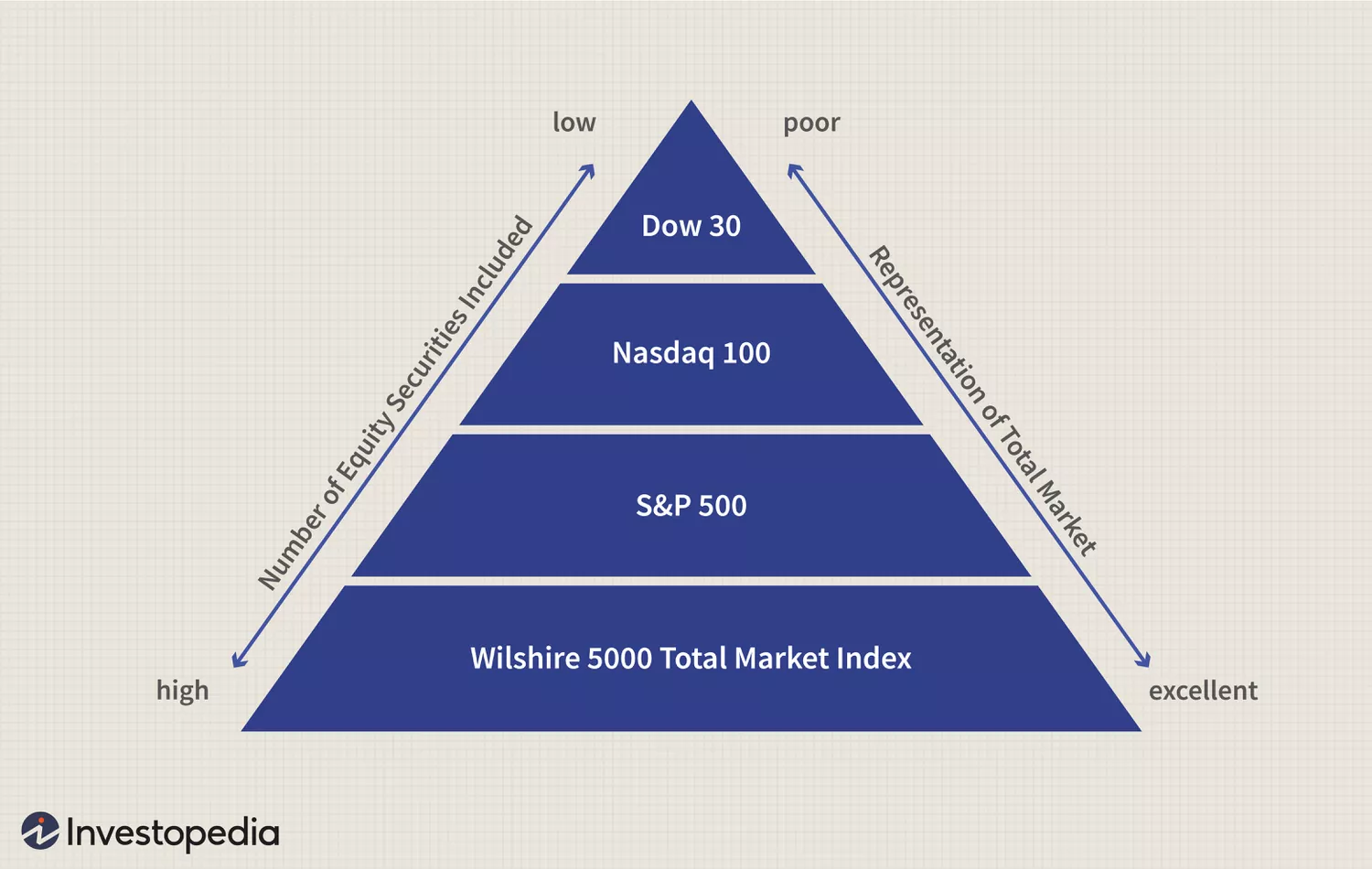

There are a variety of market indices that serve as statistical indicators of market performance。Many investors compare the Dow Jones Industrial Average(DJIA) or Nasdaq 100 An index is considered a benchmark or representative of the entire stock market。The downside is,These indices are only composed of 30 Tadakazu 100 Composed of only stocks。12 Perhaps the best-known and most commonly used market index to measure market performance and an indicator of the health of the economy is the Standard & Poor's 500 index。Standard & Poor's 500 Index from the United States 500 The largest companies are composed of weighted proportions。Market value。3 Continue reading,Discover other market indices that can reveal the entire stock market。 Key Points Many investors compare the Dow Jones Industrial Average (DJIA) or Nasdaq 100 One of the major indexes is considered a broad market index。 A better representative might be Wilshire 5000 or Russell 3000,Because they consider nearly the entire investable stock market,Includes large-cap stocks、Mid-cap and small-cap stocks。 Standard & Poor's 500 Index is the most popular index,It is also the index used by most investors and analysts to gauge the health of the U.S. economy.。 past ten years,Nasdaq 100 The index handily outperformed other major market indices。 Market Index Wilshire 5000 FT Wilshire 5000 The Total Index Series is one of the most broadly representative of the entire market.。 Contrary to what its name implies,Wilshire…