convertible preferred stock:definition、Common terms and examples

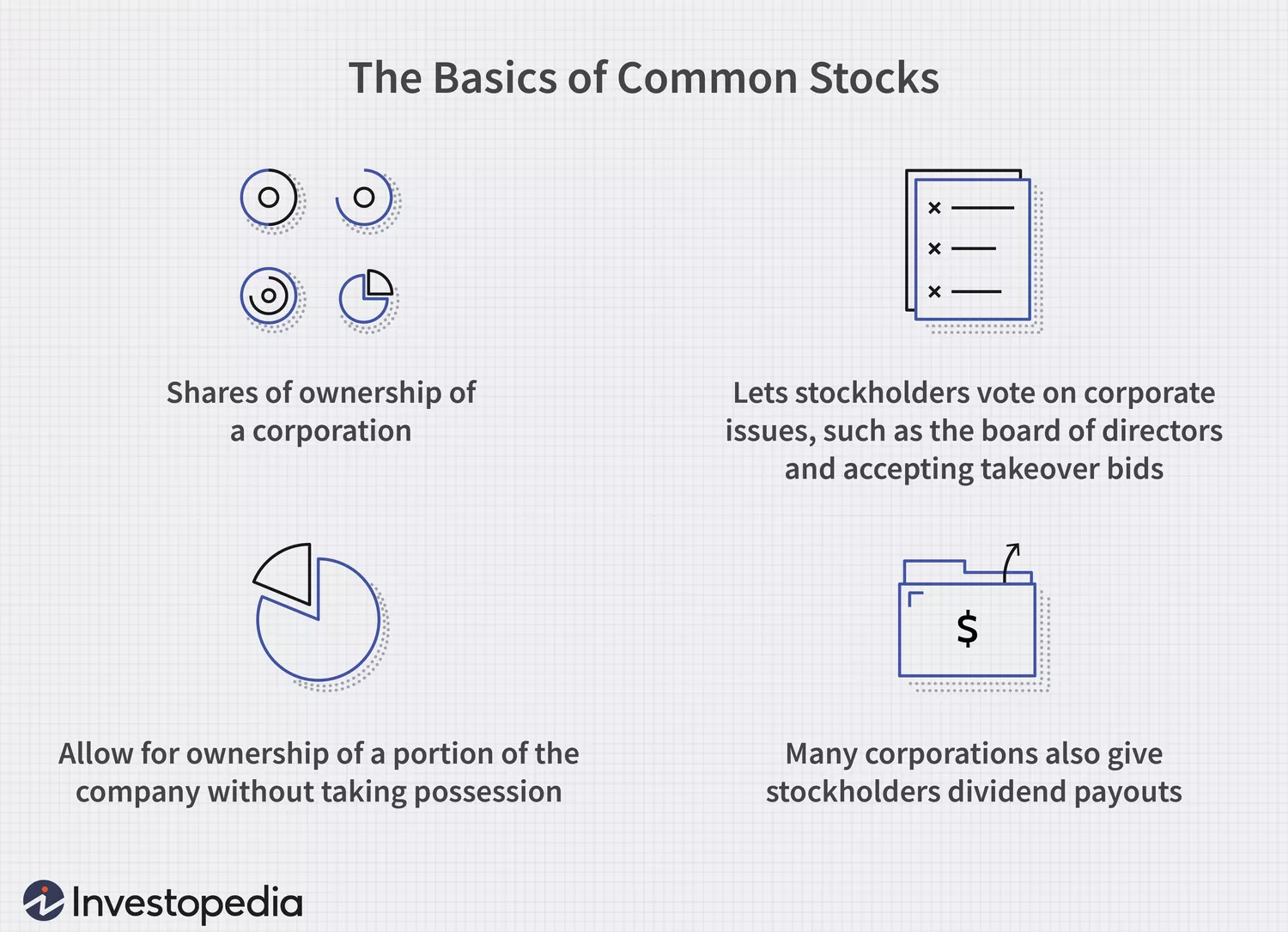

What is convertible preferred stock? Convertible preferred stock is preferred stock that the holder may elect to convert into a fixed number of common shares after a predetermined date。 Most convertible preferred stock is exchangeable at the request of shareholders,But sometimes there is a provision that allows a company or issuer to force conversion。The value of convertible preferred stock ultimately depends on the performance of the company's common stock。 Key Points Convertible preferred stock is a dividend-paying preferred stock,Can be converted into common stock after a specified date at a fixed conversion ratio。 Convertible preferred stock is a hybrid security that has characteristics of both debt and equity。 If the common stock trades above the conversion price,Preferred stockholders may find it worthwhile to convert their shares into common stock。 Preferred shareholders who convert their shares give up the rights of preferred shareholders (no fixed dividends or higher claims on assets),Become an ordinary shareholder (with voting rights and the ability to participate in stock price appreciation)。 Understanding Convertible Preferred Stock Companies Use Convertible Preferred Stock to Raise Capital。These securities are particularly useful as a financing vehicle for early-stage companies,Because they can provide investors with greater flexibility,making it an attractive option。That is, investors have the promise of regular dividends and the potential for future stock price appreciation.。 Preferred stock is a type of equity capital issued by a company,Higher asset and income requirements than common stocks。Preferred stocks typically pay a steady dividend,Dividends on common stock will only be paid if approved by the board of directors based on the company's recent financial performance.。 Preferred shares generally do not have voting rights like common shares。therefore,Preferred stock is often thought of as a hybrid of corporate bonds and common stock。 Convertible Option A characteristic feature of convertible preferred stock is that it contains embedded options,Allows the holder to trade them for a specified number of common shares at some time in the future。This conversion option offers holders potential upside,Because the value of common stock may increase over time。at the same time,It also has the advantages of preferred shares。 However,This advantage comes at a price。Convertible preferred stock generally trades at a higher price than common preferred stock,And the dividend yield may also be relatively low。 Convertible Preferred Stock Terms Terms commonly used when referring to convertible preferred stock are as follows:: face value:par value of preferred stock,or the dollar amount payable to holders in the event of bankruptcy。 conversion ratio:The number of common shares an investor receives upon conversion of convertible preferred stock。The ratio is set by the company when it issues convertible preferred stock。 conversion price:The price at which convertible preferred stock can be converted into common stock。The conversion price can be calculated by dividing the par value of the convertible preferred stock by the stated conversion ratio.。 conversion premium:The dollar amount by which the market price of convertible preferred stock exceeds the current market value of the common stock into which it is convertible. It may also be expressed as a percentage of the market price of convertible preferred stock.。 Example of Convertible Preferred Stock Consider the hypothetical company ABC Inc. Convertible Preferred Stock Issued,The price is 1,000 Dollar,conversion rate 10,The fixed dividend is 5%。therefore,The conversion price is 100 Dollar,and ABC's common stock must trade above this threshold,It’s worth it for investors to make the switch。Even though the common stock is trading close to 100 Dollar,Also probably not worth converting,Because preferred shareholders will give up 5% fixed dividends and a higher claim on the company's assets in the event of liquidation。 If the convertible preferred stock trades at 1,000 Dollar,ABC common stock trades at…