相对强弱指数(RSI)由J. Welles Wilder开发。他首先在一本名为“新概念技术系统”的书中谈到了他的系统,该书于1978年一直发布。显然他是个书呆子。

RSI的作用是将股票近期涨幅的幅度与近期跌幅的幅度进行比较。从那里,在0到100之间导出一个数字以区分该比较。For example,对于14期RSI,平均增益等于所有增益的总和除以14.如果在这14个交易日内仅有8个增益,则数量仍为14无关紧要。平均损失为在类似的庄园中找到。

如何使用RSI

我没有进入所有的数学方程式来展示RSI,而是通过观察和观察,发现它更容易学习10倍。你需要了解一些事项:

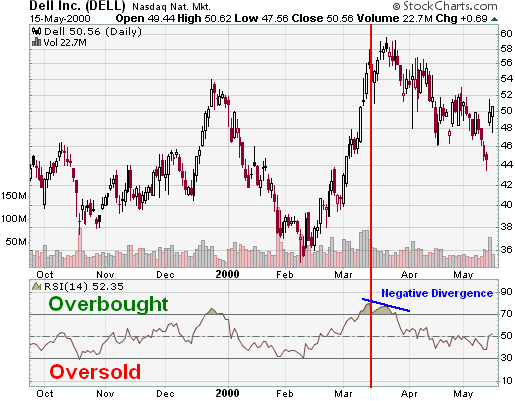

- overbought -如果RSI显示高于70的水平A股处于超买。

- oversold – 如果RSI显示低于30的水平,则股票超卖。

RSI的中心线为50.理解主要概念非常简单。如果股票显示RSI小于50,我们可以说平均损失大于平均收益,而RSI高于50,我们可以说平均收益大于平均损失。

视觉示例

therefore,在查看戴尔计算机(DELL)的这张图表时,我们可以看到股票如何在RSI上升至70以上的情况下上涨至54美元以上。股票随后产生了负面背离,因为你可以看到蓝色接下来的几周。这总体上看跌,你可以看到股票如何失去动力并在50美元的低位卖出,最终卖出40美元。